Can recent regulatory reforms turn the tide for UK stocks?

UK stocks have fallen out of favour with investors due to sectoral imbalances and macroeconomic challenges. Recent reforms aim to restore investor confidence and attract capital back to London.

UK stocks' underperformance relative to their developed market (DM) peers is well-documented and widely analyzed. Commentators have pointed to the over-representation of "old economy" sectors like oil and gas in the UK stock exchange, which has come at the expense of more dynamic sectors like technology. The 2016 Brexit referendum exacerbated this performance gap, as investors were deterred by the resulting political uncertainty.

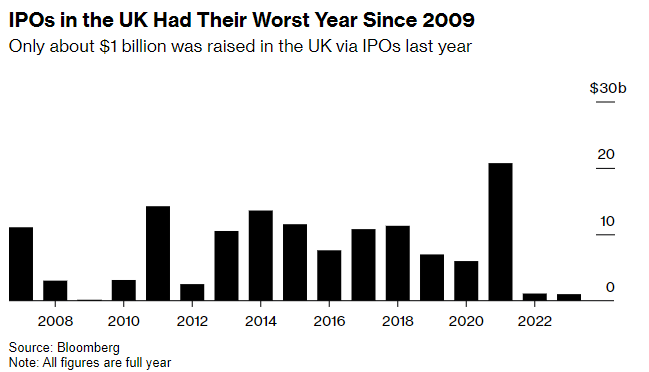

This underperformance has become increasingly troubling over time. Since the pandemic, several listed companies have opted to de-list and shift to better-performing indices. The number of IPOs in the UK has declined, and companies are increasingly bypassing London as a listing venue.

What’s driving the growing negativity towards UK stocks? Could the recent regulatory reforms reverse this trend and boost market performance?

A review of UK stocks' relative performance:

Early 2000s:

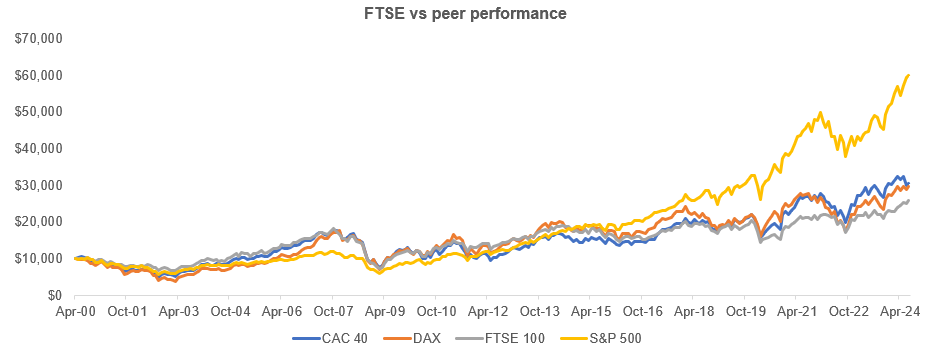

The FTSE-100—UK’s benchmark stock exchange—outperformed peers between April 2000 and December 2006. It appreciated 57% against CAC’s 50%, DAX’s 29% and S&P’s 9%. The bursting of the dot-com bubble in the late 90s had a detrimental impact on indices with a heavy concentration of technology companies. The FTSE, however, was relatively insulated from this downturn. Additionally, the commodity price boom in the early 2000s benefited the FTSE with a substantial presence of Energy and Mining companies.

Post GFC:

The 2008 Global Financial Crisis (GFC) marked the beginning of FTSE's underperformance. Between January 2008 and December 2015, the FTSE gained just 4%, compared to a 5% decline for the CAC, a 15% rise for the DAX, and a 76% surge for the S&P 500. The FTSE’s sector composition largely drove this underperformance, as regulatory changes heavily impacted Financials, and Energy companies suffered from falling commodity prices. The 2010-12 Eurozone Debt Crisis also weighed on the index given the UK’s close ties with the Eurozone. Commentators also attribute the UK's lackluster performance to declining productivity growth and competitiveness.

Brexit:

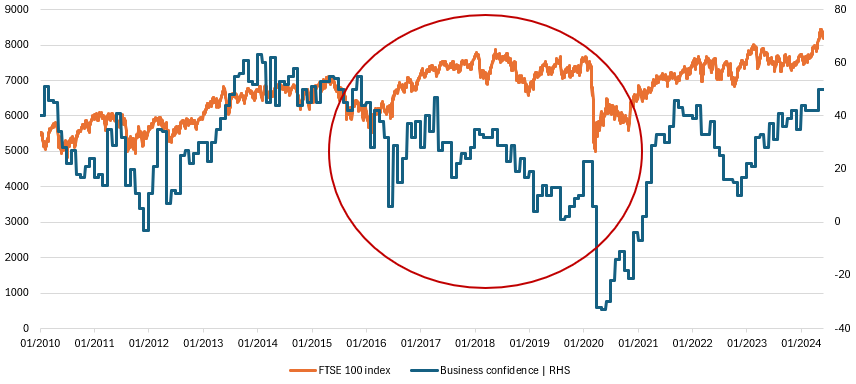

Since 2016, FTSE’s performance gap with peers has substantially widened. Between January 2016 and July 2024, the FTSE appreciated 72% against CAC’s 121%, DAX’s 87% and S&P’s 232%. The uncertainty surrounding the UK's exit from the EU—marked by a complex negotiation process and unclear future trade relationship—severely impacted investor confidence and weighed heavily on the equity market.

The FTSE 100 went nowhere between 2016 and 2019 as business confidence languished.

FTSE returns have been the least impressive in the past 2 decades:

Other structural weaknesses have also weighed on the stock market:

Diminishing trading volumes:

FTSE’s average daily traded volume—an important indicator of a financial market’s liquidity— declined from USD 15 billion in February 2007 to USD 3.4 billion in February 2024. This indicates diminishing activity and higher volatility in asset prices. Investors tend to pay less for illiquid stocks and bonds given the higher risk of executing trades. This is also driving FTSE’s valuation gap against peers. As of July 2024, the MSCI UK index traded at a 45% and 37% discount to the MSCI US index and the MSCI World index based on the forward P/E ratio.

Sectoral composition:

Various market commentators have often cited the under-representation of the tech sector as one of the main reasons behind FTSE’s lagging performance. Technology constitutes 1-2% of the FTSE 100 against 28% of the S&P 500, 6-7% of CAC 40, and 13% of the DAX. However, this lack of tech exposure has occasionally worked to the FTSE's advantage. For instance, it was relatively immune to the decline in tech stocks in 2022 amidst rising interest rates.

The decreasing attractiveness of London as a destination for share listings:

Local and international companies are increasingly opting to list in higher-growth jurisdictions like the US. Building materials maker CRH switched its primary listing to the US in 2023. The valuation gap between US and UK indices, stringent regulatory requirements in the UK, and local institutional investors’ bias against tech companies drove this decision. In 2023, UK corporates constituted 14% of the capital raised by local startups compared to 43% in the US. This lackluster enthusiasm is due to lower returns in the UK and a lack of investment in innovation compared to the US.

Startup listings in the UK declined 40% since 2008 to their lowest last year. British semiconductor manufacturer ARM decided to list in the US in 2023 to achieve a higher profile and valuation. It was previously listed in both London and New York before its takeover by Softbank in 2016. This hesitation to list was driven by several underperforming startup listings including The Hut Group in 2020, Deliveroo and Dr. Martens Plc in 2021, and Ithaca Energy Plc in 2022.

What is London doing to win back corporate trust?

The UK government is taking several steps to revitalize the equity market. In 2023, the Treasury mandated that local pension funds allocate at least 5% of their portfolios to listed growth companies by 2050. This move addresses the sharp decline in domestic equity investments by pension funds, which fell from over 50% in the early 2000s to just 4% in 2023.

Additionally, the Financial Conduct Authority (FCA) is working to ease regulatory restrictions for UK listings. Proposed changes include simplifying the listing process by merging standard and premium categories, relaxing rules on shareholder approval, and offering greater flexibility on disclosures. The FCA’s 2021 introduction of dual-class share structures and a lower free-float requirement aimed to attract technology companies to the UK market. These ongoing reforms align with international standards and seek to reduce regulatory barriers.

UK equity funds have faced persistent outflows since 2016, impacting their valuations. Contributing factors include Brexit-related uncertainty, high post-COVID inflation, and slowing economic growth. Despite these challenges, the UK's macroeconomic and geopolitical outlook has improved. CPI inflation fell to 2% in May 2024 from 8% last year and the Bank of England (BoE) cut the policy interest rate for the first time since 2022 this August to stimulate growth. The new Labour administration is keen to improve ties with the EU, which could further bolster business confidence.

Retail investor holdings in local stocks have dropped from 54% in the 1960s to 12% in 2020. The FCA’s July 2024 Prospectus Reform, aims to remove barriers to participation for retail investors both during IPO and when the company issues further shares later on. This should increase the pool of investors for local companies and boost the equity market.

Conclusion:

The underperformance of UK stocks relative to their developed market peers reflects a complex interplay of sectoral imbalances, political uncertainty, and shifting investor preferences. Brexit has significantly exacerbated these issues, creating a prolonged period of investor uncertainty and eroding confidence in the UK's equity market.

For a meaningful turnaround, continued focus on enhancing market attractiveness and investor confidence is crucial. The slew of reforms announced by the FCA represent a promising step in this direction by aiming to attract company listings, ease capital raising, and boost investor participation.

Want to go deeper?

If you’ve found my writing useful and want to explore how macro and strategic thinking could apply to your work or career, I occasionally support professionals 1:1. Learn more here.