Navigating the Surge in Interest Rates: Strategies for Investors

Recent economic data and central bank comments point to higher for longer interest rates. This brings opportunities and risks for an investor's portfolio.

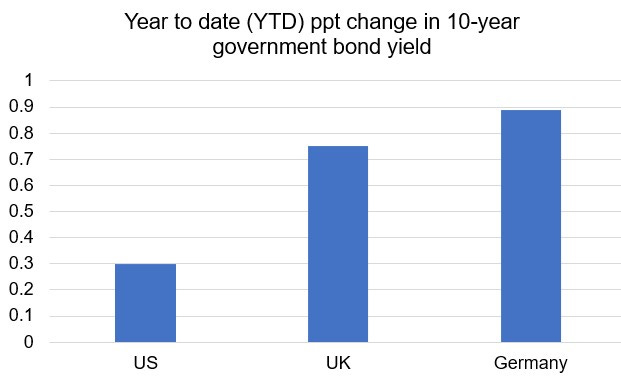

The financial news over the past few months has been dominated by the persistent increase in US government bond (also known as US Treasury) yields. This has driven yields across the global bond market higher as US Treasury bonds (USTs) are the safest asset class and all other bonds are priced relative to them.

This rise in interest rates is driven by several structural factors including the strong US economy, stubborn inflation, and shifting investor expectations. In this article, I will discuss the reasons driving these rate spikes, market reaction, and considerations for an investor’s portfolio.

What is driving yields higher?

Several structural factors are driving US government bond yields higher including:

Aggressive interest rate hikes by the Fed, which has raised the policy rate to 5.5%, the highest in twenty-two years

Q2 Gross Domestic Product (GDP) growth in the US exceeded expectations at 2.1% y/y versus a 1.8% consensus estimate led by the historically low unemployment rate and solid consumer spending

Headline inflation remained above the Fed’s 2% target at 3.2% y/y in July, prompting hawkish statements from the Fed

The growing realization in the investor community that interest rates will stay higher for longer as the US economy remains robust and inflation is taking time to cool. US interest rates will drive other central banks to keep their monetary policy tight in order to support their local currencies and prevent capital outflow into the US

A quick segue to the Jackson Hole Summit and why it is important for you:

The Jackson Hole Economic Symposium took place last week between 24-26 August. It is an annual 3-day international conference hosted by the Federal Reserve Bank of Kansas City in Jackson Hole, United States. The Kansas City Fed invites central bankers, academics, and economists from across the world to discuss the global economy at this symposium.

Digressing for a minute here – I have dreamed about becoming a central banker just to attend this summit and appear oh so cool!

Jackson Hole:

At this year’s symposium, several central bankers discussed the economic factors driving inflation higher than their respective targets. For instance, European Central Bank (ECB) president Christine Lagarde alluded to the historically low unemployment rate in Europe and supply shocks that are driving firms to raise prices. Both these factors may drive continued inflation pressures. Bank of England (BoE) Deputy Governor Ben Broadbent stated the unlikelihood that inflation will disappear anytime soon and that interest rates will need to remain in restrictive territory. Federal Reserve Chair Jerome Powell said that the Fed would focus on stamping out inflation “until the job is done.”

These statements highlight central bankers’ proclivity to maintain interest rates at their currently elevated levels and hike them further based on economic data.

How are these factors impacting the global economy and financial markets?

The global bond market saw rising yields through most of August as market participants digested strong economic news and realized that interest rates may need to stay higher for longer. The 2Y UST yield is currently hovering around 5%, the highest since 2007! The MSCI All Country World Index (ACWI, representing 85% of the global investible stock market) fell ~6% month to date till 18 August before stabilizing. Rising bond yields curb corporations’ ability to borrow and invest in their business.

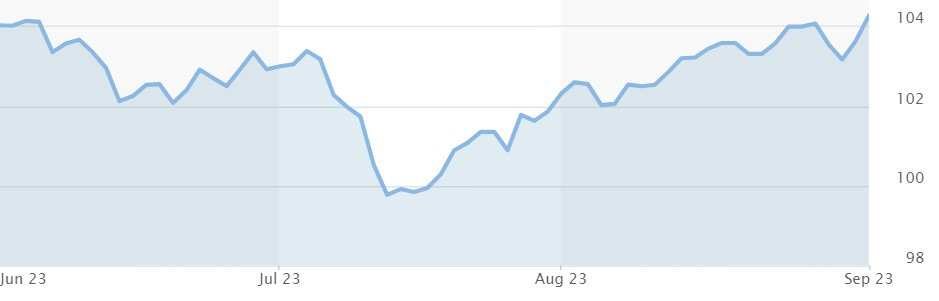

The US Dollar (USD) (indicated by the DXY index) strengthened against other major currencies as greater investor allocation to USTs and US assets raised dollar demand. Emerging market equities and currencies suffered as global investors took money out of these riskier markets.

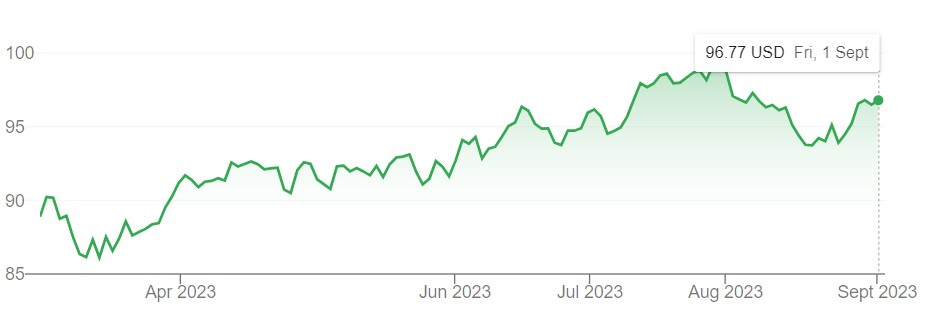

The iShares MSCI ACWI ETF (tracking the MSCI ACWI index) corrected in August):

Source: Nasdaq.com

US Dollar DXY index has been rising since July:

Source: Market Watch. The DXY index measures the USD against six major currencies. An increasing index value shows USD strengthening against the rest.

Considerations for an investor’s portfolio:

Strong economic data, above-target interest rates, and central banks’ hawkish comments suggest that interest rates may remain higher for longer. This has implications for an investor’s portfolio:

Bond yields globally are at historical highs and offer solid returns at lower risk compared to equities. Investing in quality bonds with strong fundamentals would be a safe bet

Central bank policy rates have nudged banks to offer higher savings rates on cash deposits, providing another attractive income source with low risk

Higher for longer rates suggest persisting difficulties in financing housing mortgages. This is likely to see corrections in the housing market, the UK being a great example

Emerging market (EM) equities are more vulnerable in a high rates environment due to two reasons:

Investors will be inclined to pull their money out of riskier EMs and towards the safety of the US and other developed market assets

The strength of the Chinese economy drives investor flows into other EM equities. Chinese data has been quite weak despite the economic reopening post-COVID and this is likely to weigh on the attractiveness of EM equities

Rising bond yields typically hurt equity market returns as firms find difficulties in accessing credit, refinancing debt, and growing their business

However, pockets within the equity market may thrive during high rates and recession fears. These include blue-chip stocks, consumer staples, utilities, and healthcare as these sectors are often seen as defensive given the perennial demand for their goods

Equity investors may also consider geographies that are seeing resilient growth including the US and Asia. In its regional economic outlook, the IMF projected Asia to contribute 70% of global growth in 2023 by growing at 4.6%

The best strategy to manage the risk of financial market volatility is to diversify your portfolio across bonds, stocks, alternative assets, currencies, and geographies

The latest central bank commentary suggests that central bankers are hesitant to declare victory over inflation. Further rate hikes may be expected as per incoming economic data. Despite the financial market volatility this brings, there are pockets of opportunities an investor can consider.

How are you amending your investment portfolio in reaction to the changing macroeconomic environment? Let me know in the comments section!