What 2024 taught us about portfolio construction.

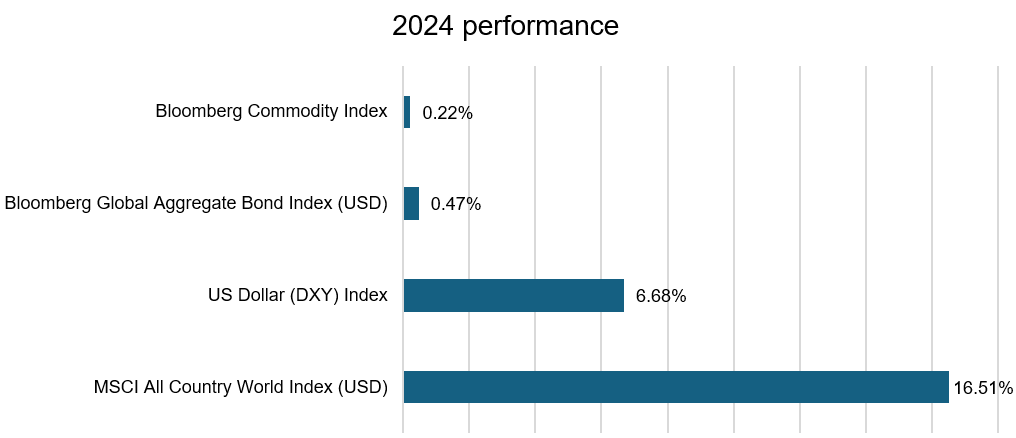

AI-driven tech rallies, disappointing fixed income returns, and central banks’ gold buying – 2024 taught us many lessons in portfolio construction and risk management.

2024 defied macro and market expectations on many fronts. The world’s two largest economies, the US and China, outpaced growth forecasts, with American consumers driving spending and China doubling down on infrastructure investment. Even the UK—frequently criticized for its economic stagnation—surpassed forecasts driven by increased government spending.

Towards the end of 2023, the market had confidently priced in a sharp pivot from central banks, anticipating six quarter-point Fed rate cuts in 2024 amid slowing growth and cooling inflation. Yet reality unfolded differently. The Fed executed just four cuts, held back by a resilient economy and stubborn services inflation—a dynamic mirrored across developed markets.

Meanwhile, politics and geopolitics stole the spotlight. Donald Trump’s sweeping electoral victory reignited trade tensions and signaled a new era of America-first policy approach. Outside the US, various mature economies grappled with government failure: France faced a no-confidence vote within months of the elections, Germany’s coalition government collapsed, and South Korea declared martial law for the first time in 40 years.

How did these seismic shifts shape markets? How did markets perform against expectations and what can individual investors and asset managers learn about portfolio construction?

2024 asset class performance:

Equity market:

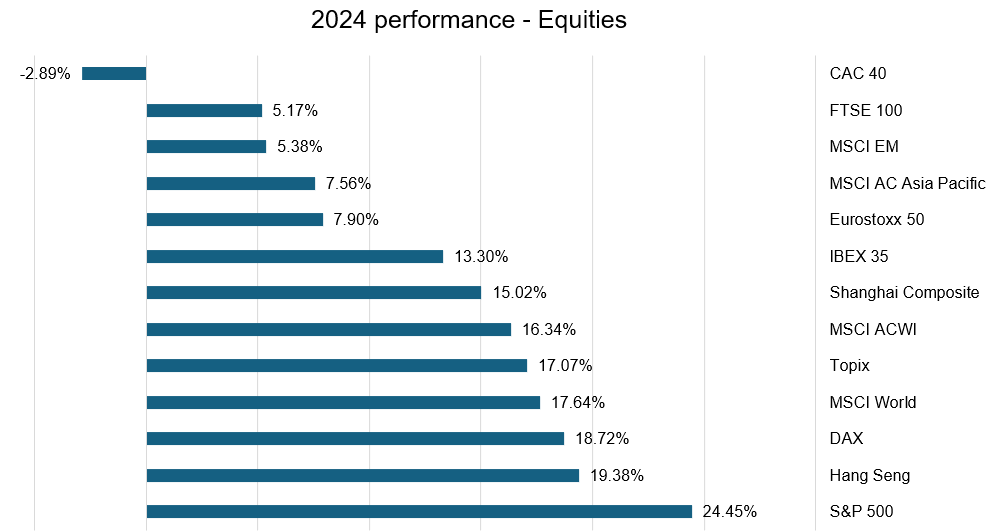

The equity market (MSCI ACWI) outperformed other asset classes spearheaded by the S&P 500, up 25% last year. Developed markets (MSCI World) outperformed emerging markets (MSCI EM) by 12.3 percentage points, continuing a decade-long trend of DM equities delivering higher returns (10.1% annualized vs. EM's 3.5%).

Chart: Equity market performance in 2024

A few themes emerged from the equity market performance last year.

Tech was a clear winner: Tech stocks drove the S&P and DAX’s stellar performance last year. AI stocks like Nvidia, Broadcom, and Palantir in the US and SAP in Germany drove both indices’ performance.

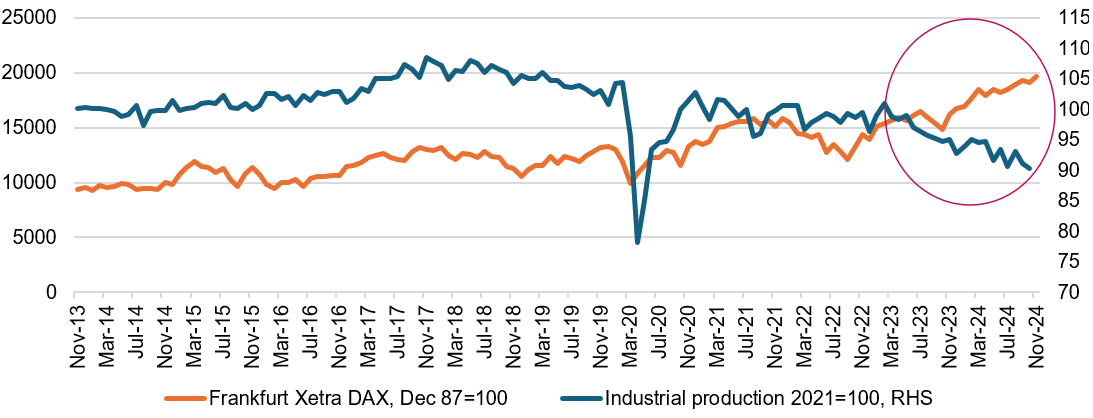

The DAX’s evolution from being industrials heavy to now having more finance and tech heavyweights like SAP and Allianz is boosting its performance. However, its performance contrasts with Germany’s mounting economic challenges. The country’s economic backbone—the automotive sector—faces substantial headwinds like inflation, competition from Chinese EVs, and weak global demand. Furthermore, the DAX’s current P/E ratio of 16.7x, above its historical average of 13.5x, underscores a potential divergence from the underlying economic fundamentals.

Chart: Germany stock market performance vs industrial production (proxy for economic activity)

Cheap valuation and fiscal stimulus supported China and Hong Kong: Hong Kong’s Hang Seng Index rallied 19.4% in 2024 surpassing the MSCI AC Asia Pacific’s 9.3%. This marked a turnaround for an index that had lagged the region since 2017, weighed down by political uncertainty and social unrest. The rally was primarily driven by China's stimulus measures and the Hang Seng's historically depressed valuation.

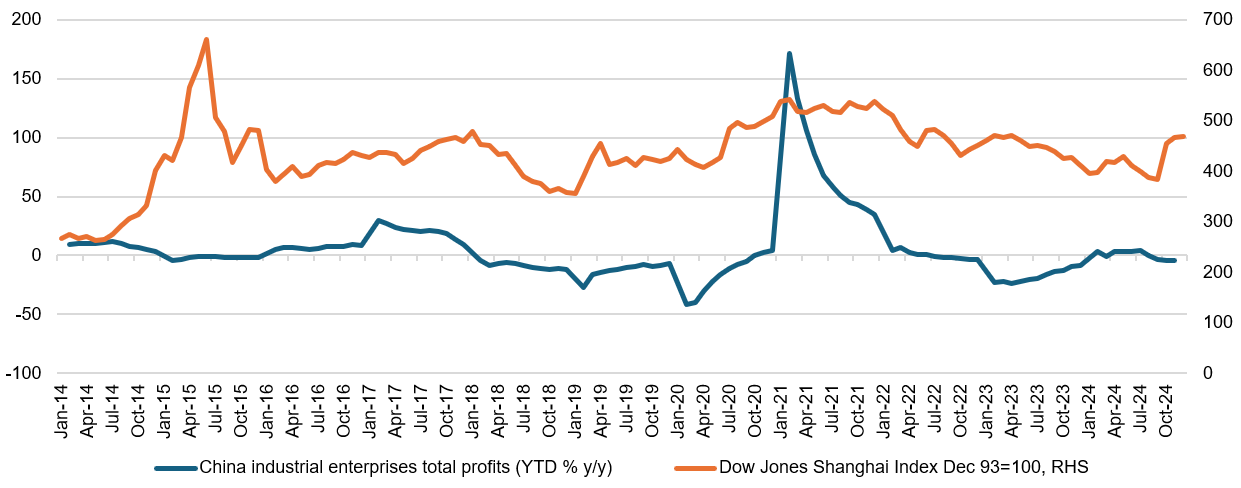

The Shanghai Composite climbed 15.0%, with much of the gains materializing after September’s major stimulus announcement. However, mixed economic signals suggest the recovery is still fragile. Industrial profits have been contracting since August due to weak demand and deflation risks, while daily necessities retail sales sharply slowed to 1.3% y/y in November from 8.5% in October. On the brighter side, the Caixin Manufacturing PMI has steadily improved since September, reaching 51.5 in November. Sustained data improvements will be essential to confirm that the economy has turned a corner.

Chart: China industrial profits vs stock market performance.

The chart above indicates that industrial profit data tends to lead the equity market and can be a good measure to confirm whether the economy has bottomed.

Economic strength and structural reforms drove the IBEX and Topix. Conversely, political uncertainty weighed on the French market.

Spain’s IBEX gained 13.3% led by strong economic and corporate performance. The higher interest rate environment drove banking sector stocks (~30% of the index). Spain’s economy is outperforming Eurozone peers with GDP expected to grow 3% y/y in 2024 compared to the Euro Area at 0.8%. One decade of structural reforms spanning banking sector consolidation, labor market flexibility, and fiscal rules have collectively driven the economic performance.

Japanese stocks are currently reaching levels not seen since the late 1980s. A return to inflation post-pandemic after years of deflation and a series of tough corporate governance reforms are buoying the market.

On the other hand, France’s CAC-40 was the only major DM stock exchange that fell last year, its worst performance since the Eurozone debt crisis. Government instability and weak sales in the mainstay luxury goods sector held the index back. Moody’s downgraded France’s credit rating in December citing a materially weaker economic outlook and fiscal deterioration.

Fixed income:

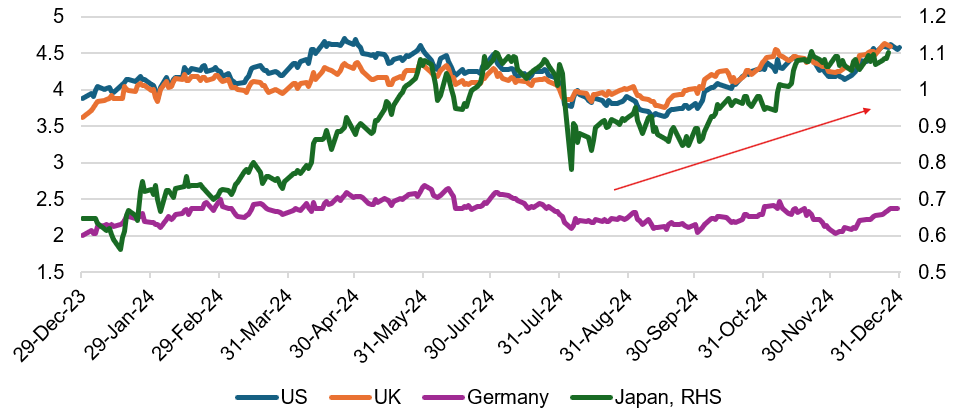

Bond returns lagged as the market predicted sharper central bank rate cuts in 2024 on the back of easing inflation pressures and economic growth. However, inflation turned out to be stickier than expected led by services like housing and recreation.

The market was pricing in six 25bps rate cuts in the US and UK. Instead, it got four in the US and two in the UK. As expectations did not materialize, bond markets sold off, causing government bond yields to rise across major advanced economies. The political uncertainty alluded to previously exacerbated the sell-off in France with the 10Y yield up 41bps in 2024.

Chart: 10Y bond yields across major advanced economies.

Commodities:

Gold and silver rallied over 20% in 2024 as safe-haven demand grew amidst geopolitical tensions. Central banks have been enthusiastic buyers of gold over the past few years, using the metal as a natural hedge against inflation and to diversify away from the US Dollar. According to the World Gold Council, central banks held ~20% of mined gold as of Q2 2024.

How did asset classes perform relative to expectations?

Equities: Many sell-side research firms expected US exceptionalism in 2024 due to solid earnings and productivity growth, leading to USD outperformance. Both predictions were correct. The S&P 500 gained 25% while the dollar was up ~7%. Despite the S&P’s lofty valuation, earnings growth of 9.4% against the 10-year average of 8% continued to boost stock prices. The market expects double-digit earnings growth of 14.8% in 2025 suggesting another stellar year for the index. However, high valuations warrant careful sector selection and a focus on earnings sustainability.

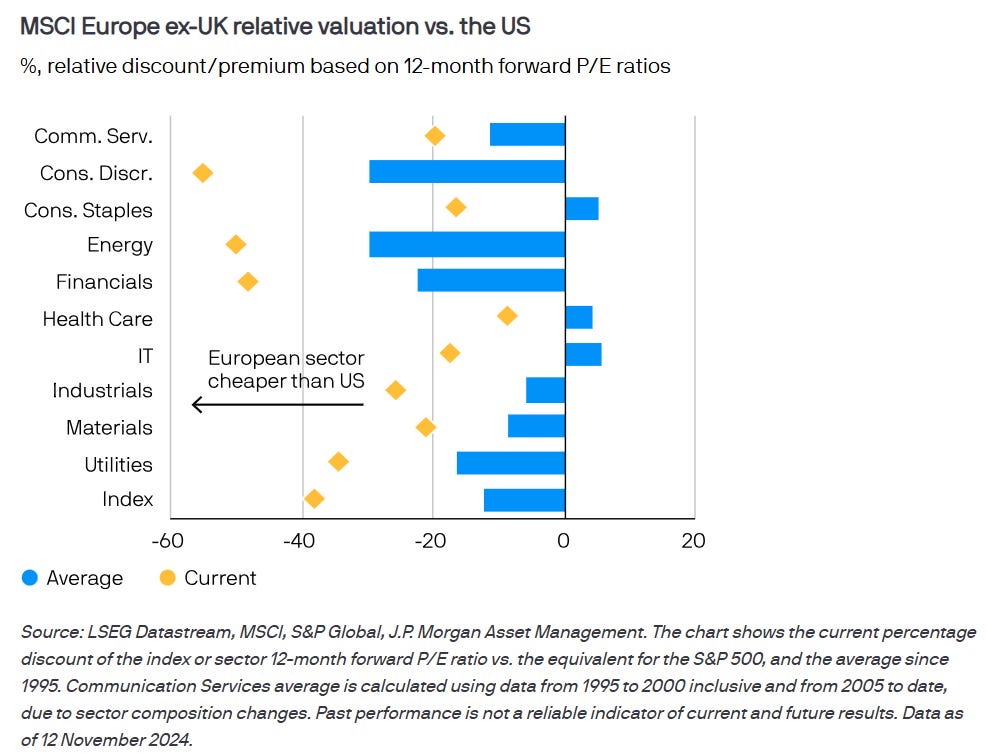

Some sell-side outlooks favored European equities due to their relatively cheap valuation. Despite this, the Stoxx Europe 600 was up 6.6% in line with its 10-year average annualized return. The MSCI Europe ex-UK index traded at a 35% discount to the S&P 500 (as of November 2024) and each sector traded at an above-average discount as well. Therefore, European stocks could be a good diversifier to the portfolio, especially if US tech companies underperform earnings expectations for whatever reason.

Chart: MSCI Europe relative valuation to the US.

The analyst community favored Chinese equities given their historically low and attractive valuation at the end of 2023. After peaking in 2021, stocks declined due to COVID lockdowns, property sector challenges, and economic headwinds. The September rally highlighted how depressed valuation and bearish sentiment can amplify upside potential. Chinese equities remain historically cheap, and fiscal policy cues could further catalyze sectors with greater government focus.

Many expected the EM equity market return to be muted due to a weak Chinese economy. However, the MSCI EM (USD) was up ~5.4%, above its 10-year average of 3.5%. Taiwan’s semiconductor and AI stocks supported the index, underlining global tech sector outperformance. The AI boom underscores the importance of thematic investing. Sectors such as semiconductors and technology are becoming essential components of diversified portfolios.

Fixed income: Markets misjudged the rate cut trajectory in 2024, as inflation risks and strong growth limited easing. The Bloomberg Barclays Global Aggregate Index returned a modest 0.5%, reflecting rising DM government bond yields. This highlights the risk of overweighting duration in uncertain inflationary environments.

A surprising development was that French government bond yields exceeded those of Greece for the first time in November 2024. It underscores how fiscal risks in developed economies can outweigh historical perceptions of risk, challenging assumptions in sovereign bond allocations. This is something to be especially mindful of considering the US fiscal deterioration.

Learnings for portfolio construction:

So what does this imply for portfolio construction?

Avoid recency bias in forecasting: Forecasters have been operating under a recency bias –i.e. interest rates were low pre-COVID and this is where they should settle in the future. However, it has become increasingly clear that we are in a new economic paradigm—historically elevated debt levels, political uncertainty in advanced economies, geopolitical fractures, and their implications for supply chains explain why interest rates have settled at a new and higher normal. Such an environment favors shorter-duration bonds with good credit quality as long-duration bonds are more vulnerable to higher interest rates.

AI For the Win: Artificial intelligence upended traditional market frameworks, overshadowing metrics like valuation, the alignment of stocks with the real economy, and even China’s influence on emerging markets. AI emerged as a dominant structural growth driver, fueling equity market returns. Its rise underscores the growing importance of thematic investing and the need for growth exposure in portfolios to capture the potential of transformative, long-term trends.

Seek out the Negative Nellies: For the past few years, the market has been pessimistic about Hong Kong and China evidenced by multi-year stock price declines and cheap valuations. Such markets provide portfolio diversification potential, especially given the overpriced nature of US stocks. Asset managers should pay close attention to government policy focus in these countries to identify sectoral beneficiaries.

Duration management: As we saw, the market was expecting more and earlier rate cuts than what transpired. This view led many sell-side analysts to prefer long-durations bonds in anticipation of recession risks. Such examples of changing rate expectations underline the importance of dynamic duration management in a fixed-income portfolio. This includes favoring regions like Europe and Canada (in 2024) with greater justification for policy loosening, which may present opportunities for long-duration bonds. A barbell approach could also be considered as it combines short-duration bonds for stability and long-duration for price gains if rate cuts materialize.

Gold as a hedge against inflation: Gold’s rally reinforces its role as a defensive asset, particularly for portfolios seeking resilience against geopolitical shocks and inflation. 2022-23 saw record-high gold buying by central banks. This is likely to continue as the World Gold Council’s H1-2024 survey showed that 29% of central bank respondents planned to expand their gold reserves over the next twelve months. Gold offers central banks protection against sanctions, diversification to the US Dollar, and protection from inflation fluctuation.

Conclusion:

2024 reinforced the importance of adaptability in navigating a dynamic investment landscape. Whether capitalizing on structural growth themes like AI, dynamically managing duration in fixed income, or seeking value in overlooked markets like China, the year underscored that success lies in balancing opportunities with risks. Investors must remain agile, resist recency bias, and continuously re-evaluate macroeconomic paradigms and portfolio allocations.

Want to go deeper?

If you’ve found my writing useful and want to explore how macro and strategic thinking could apply to your work or career, I occasionally support professionals 1:1. Learn more here.