Navigating Stormy Seas: Business Strategies for Managing Disrupted Shipping Routes

Macroeconomic and geopolitical volatility have increased the frequency of shipping disruptions. Firms must consider a variety of strategies to proactively mitigate risks.

Rising geopolitical tensions in the Middle East, Ukraine, and other parts of the world have resulted in frequent disruptions to key shipping routes. Earlier this year, the Red Sea shipping route—handling 12% of global trade—faced major disruptions from militant attacks by the Houthis.

Such disruptions add to operating costs for companies as their vessels need to be rerouted over longer routes. This adds to transportation costs, delays goods delivery, and increases insurance premiums among other costs.

As instances of geopolitical tensions rise, firms need to proactively plan for disrupted shipping routes to minimize the impact on their business. In this note, I discuss the challenges firms are facing and the strategies they should implement to mitigate the impact of frequent disruptions to shipping routes.

The instances of shipping disruptions are rising and becoming more serious:

Ships are estimated to carry 80% of globally traded goods, underlining the significant implications of shipping disruptions. The frequency of disruptions has risen since COVID due to port closures and worker shortages at the time and thereafter with the wars in Ukraine and Gaza.

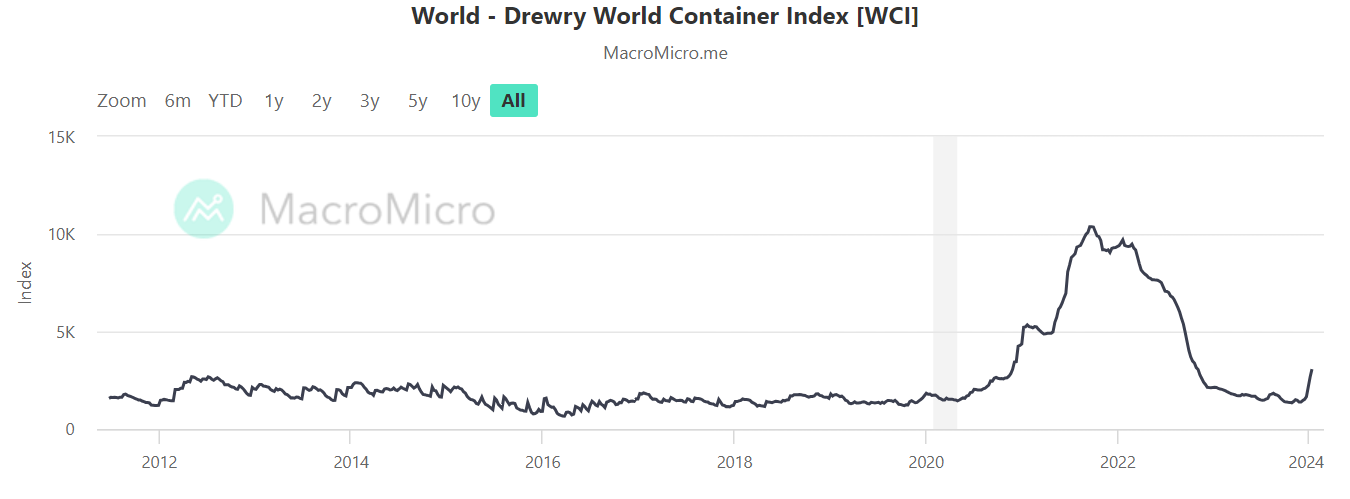

Container prices have seen frequent disruptions since COVID-19.

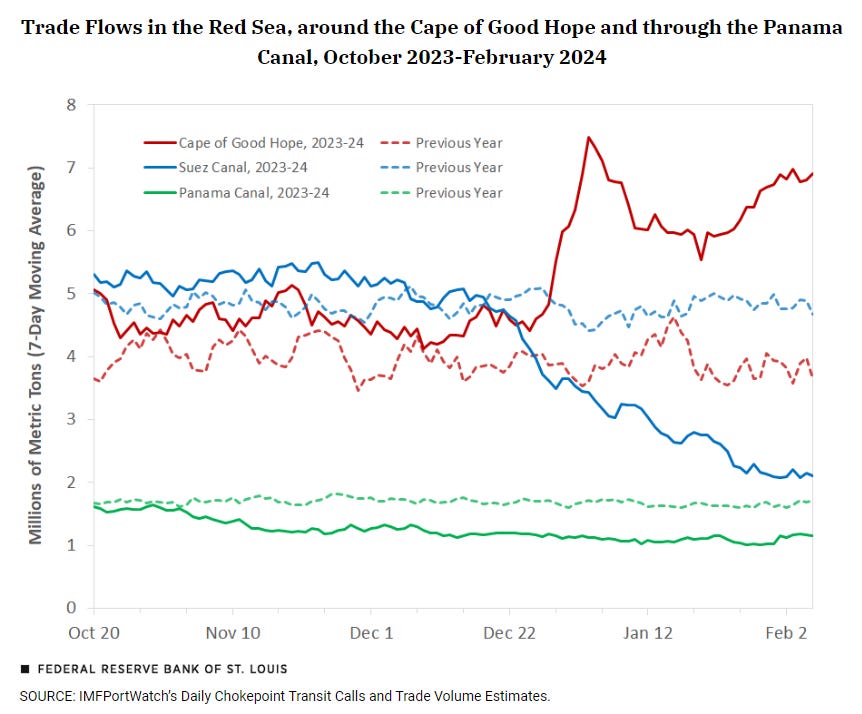

Disruptions to the Red Sea shipping route between end-2023 and February 2024 forced vessels to reroute around the Cape of Good Hope. This doubled global container freight rates and exerted pressure on company finances given the additional distance ships needed to travel and the time delay.

Shipping disruptions led by macroeconomic and geopolitical volatility have become more common over the past few years and impact corporations through various channels. Previous instances of shipping disruptions and their business implications include:

Russia-Ukraine war (February 2022 - present): The war that began in February 2022 disrupted shipping via the Black and Azov seas. With several governments banning trade with Russia, countries began importing goods from suppliers located at greater distances. This lengthened shipping routes and associated expenses. Global average bunker prices of very low sulphur fuel oil (VLSFO) peaked at over USD 1,100 per tonne in June 2022— a 75% increase compared to the beginning of the year1.

Red Sea shipping disruption (November 2023-February 2024): Following the start of the Israel-Hamas war in October, Yemen’s Houthi rebels began attacking vessels transiting through the Red Sea. This led companies to reroute their vessels around the Red Sea, increasing shipping costs in the process.

Strait of Hormuz safety concerns (2019): US-Iran tensions stoked concerns about the safety of shipping through the Strait of Hormuz, a gateway for 30% of sea-traded oil shipments. Several oil tankers were attacked in the region, leading to disruptions in oil transportation and increased insurance costs for vessels transiting through the area.

Suez Canal blockade (March 2021): The Suez Canal was blocked by container ship Ever Given for 6 days in March 2021. This halted USD 10 billion worth of trade daily and the Suez Canal authority estimated the cost of the blockade at USD 1 billion.

Maersk cyber attack (June 2017): A ransomware attack on one of the world’s largest shipping companies A.P. Moller Maersk severely disrupted its IT systems and affected container shipping, port operations, and logistics services. Maersk estimated the cost of the attack (purportedly by the Russian military) at USD 200-300 million at the time.

How shipping disruptions impact businesses:

Shipping disruptions impact company financials through several channels:

Revenue-side implications:

Lost revenue: Delays in receiving inventory and producing output result in lost company revenue. E.g., a survey conducted by Anvyl2 showed that 60% of US small and medium-sized businesses reported revenue losses of up to 15% in 2022 due to supply chain disruptions.

Cost-side implications:

Higher cost of inventory: Large stocks of inventory stuck in transit raise firms’ cost of holding inventory rather than its productive usage. Firms may decide to increase their safety stock holdings and incur warehouse storage costs, insurance, and inventory depreciation expenses.

Higher transportation costs: Shipping disruptions often necessitate rerouting cargo or using alternative transportation methods, which come with higher freight rates. E.g., container rates (for 40 ft container) increased ~187% between the end-November 2023 and end-Jan 2024 due to Houthi attacks on vessels transiting through the Red Sea.

Adverse working capital impact: In response to shipping disruptions, companies may negotiate extended payment terms with suppliers to alleviate immediate cash flow pressures. Shipping disruptions also drive delayed customer orders, resulting in delayed receivables. Delayed receivables tie up working capital that could otherwise be invested in business operations.

Other business implications:

Reputational damage: Persistent shipping disruptions can damage a company's reputation and brand image. A 2021 study by GEP showed that 40% of C-Suite executives surveyed believed supply chain disruptions had detrimentally impacted their brand image. This was led by customer complaints, delayed product launches, and loss of regular customers.3

Strategic considerations to mitigate the impact of shipping (and broader supply chain) disruptions (not an exhaustive list):

Diversify supplier base: Building an alternate and diversified supplier base can help companies reduce supplier dependencies and access alternate supply chains as backups during disruption. E.g., Procter and Gamble used backup suppliers in 20214 to bypass shipping disruptions and optimize costs. Similarly, clothing company Levi’s sources materials from 24 different countries to avoid concentration risk.

Collaborate with logistics partners to build supply chain visibility: Enhancing supply chain visibility can help companies proactively identify potential disruptions and implement timely mitigation strategies. For instance, Unilever entered into a strategic partnership with A.P. Moller Maersk in December 2021 to leverage the latter’s logistics and data expertise to build end-to-end supply chain visibility.

Consider product reformulations: Shipping disruptions in specific routes often impede access to specific raw materials. For instance, the Russia-Ukraine war diminished access to corn, soybeans, and wheat among other items as Russia and Ukraine were major exporters. Manufacturers are addressing similar constraints by actively substituting ingredients and reformulating recipes. For instance, General Mills frequently reformulated products in 2022 due to the lack of core and packaging ingredients.

Diversify transportation modes: During COVID-19 shipping disruptions, companies began using different transport modes to move goods between the EU and Asia including the China-EU rail network. More recently, companies have been transporting goods either by air or a combination of sea and air to avoid the Red Sea route since late 2023. Air freight is estimated to cost 5 times more than sea suggesting that a measured reliance on the method is suitable.

Consider nearshoring: Companies are shifting their manufacturing hubs or buying from suppliers based in countries near final demand. For instance, toymaker Mattel announced a USD 50 million investment to expand manufacturing in Mexico and bring its supply chain closer home in 2022.5

Use technology to respond to supply disruptions: Global companies are using AI to enhance supply chain visibility and be agile when facing disruptions. AI is helping companies like Unilever and Siemens find alternative suppliers on short notice during disruptions6.

Conclusion:

Shipping disruptions are becoming more frequent due to macroeconomic turbulence and geopolitical tensions. These disruptions increase firms’ operating expenditures through higher transportation costs and adverse working capital changes. Firms must proactively implement strategies to mitigate the impact of shipping disruptions by diversifying their supplier base, building supply chain visibility, and amending their manufacturing base while continuously brainstorming other initiatives.

Want to go deeper?

If you’ve found my writing useful and want to explore how macro and strategic thinking could apply to your work or career, I occasionally support professionals 1:1. Learn more here.

OECD, Impacts of Russia’s war of aggression against Ukraine on the shipping and shipbuilding markets, 10 November 2023

Supply Chain Brain, 60% of Businesses Experienced Significant 2022 Revenue Losses Due to Supply Chain Issues, 12 April 2023

Supply Chain Digital, GEP: Brand reputations damaged over supply chain disruption, 24 March 2021

Supply Chain Dive, P&G shifts suppliers, product formulas to avoid supply chain issues, 22 October 2021

Reuters, Toymaker Mattel expands Mexican plant in 'nearshoring' push, 1 April 2022

Harvard Business Review, How global companies use AI to Prevent Supply Chain Disruptions, 23 November 2023